India moved a step closer towards implementing the goods and services tax (GST) after the centre and the states struck a consensus on the rates and structure of the ambitious tax reform.

Although, it was aimed to implement GST from 1 April 2017, but this took too much contingent on both sides finalizing the design of GST, including the supporting legislation and finally agreed to make it effect from 1st July 2017.

GST, abbreviation for Goods and Service Tax. GST is also known as Value Added Tax (VAT) in few countries. GST is a consumption based tax wherein the basic principle is to tax the value addition at the each business stage. To achieve this, tax paid on purchases is allowed as a set off/ credit against liability on output/income.

GST is levied on all transaction of goods and services. Thus, in principle, GST should not differentiate between ‘goods’ and ‘services’

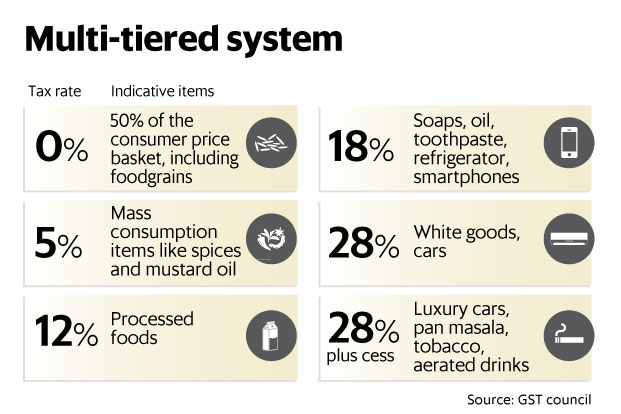

As per the rate structure agreed upon by the council on Thursday, a zero tax rate will apply to 50% of the items present in the consumer price index basket, including foodgrains such as rice and wheat.

The next tax slab will be 5%, wherein items of mass consumption like spices, tea and mustard oil will be taxed. There will be two standard rates of 12% and 18% where a majority of the items used by the common man will be taxed. There will be a higher slab of 28% where items currently attracting a tax of 27-31% will be taxed. However, items used by the middle class such as toothpastes, soaps and refrigerators, which currently have a high tax incidence of more than 27%, will be brought down into the lower slab of 18%.

Now Let’s make GST clear with an example :

Transaction includes Manufacturer, Wholesaler, Retailer and Consumer.

Stage 1 (Manufacturer)

Imagine a manufacturer of Trouser . He buys raw material or inputs — cloth, thread, buttons, tailoring equipment — worth Rs 100 a sum that includes a tax of Rs 10. With these raw materials, he manufactures a trouser

In the process of creating the trouser, the manufacturer adds value to the materials he started out with. Let us take this value added by him to be Rs 30. The gross value of his good would, then, be Rs 100 + 30, or Rs 130.

At a tax rate of 10%, the tax on output (trouser) will then be Rs 13. But under GST, he can set off this tax (Rs 13) against the tax he has already paid on raw material/inputs (Rs 10). Therefore, the effective GST incidence on the manufacturer is only Rs 3 (13 – 10).

Stage 2 (Manufacturer to Wholesaler)

The next stage is that of the good passing from the manufacturer to the wholesaler. The wholesaler purchases it for Rs 130, and adds on value (which is basically his ‘margin’) of, say, Rs 20. The gross value of the good he sells would then be Rs 130 + 20 — or a total of Rs 150.

A 10% tax on this amount will be Rs 15. But again, under GST, he can set off the tax on his output (Rs 15) against the tax on his purchased good from the manufacturer (Rs 13). Thus, the effective GST incidence on the wholesaler is only Rs 2 (15 – 13).

Stage 3 (Wholesaler to Retailer)

In the final stage, a retailer buys the trouser from the wholesaler. To his purchase price of Rs 150, he adds value, or margin, of, say, Rs 10. The gross value of what he sells, therefore, goes up to Rs 150 + 10, or Rs 160. The tax on this, at 10%, will be Rs 16. But by setting off this tax (Rs 16) against the tax on his purchase from the wholesaler (Rs 15), the retailer brings down the effective GST incidence on himself to Re 1 (16 –15).

Thus, the total GST on the entire value chain from the raw material/input suppliers (who can claim no tax credit since they haven’t purchased anything themselves) through the manufacturer, wholesaler and retailer is, Rs 10 + 3 +2 + 1, or Rs 16.

What’s the actual merits and demerits of GST Implementation:

The GST is a Value added Tax (VAT) is proposed to be a comprehensive indirect tax levy on manufacture, sale and consumption of goods as well as services at the national level. It will replace all indirect taxes levied on goods and services by the Indian Central and State governments. Though GST is considered to be a historical tax reform in India, it also has some demerits. We here would look into GST Taxation and deal with its advantages and disadvantages.

GST Advantages

- GST is a transparent tax and also reduce number of indirect taxes.

- GST will not be a cost to registered retailers therefore there will be no hidden taxes and and the cost of doing business will be lower.

- Benefit people as prices will come down which in turn will help companies as consumption will increase.

- There is no doubt that in production and distribution of goods, services are increasingly used or consumed and vice versa.

- Separate taxes for goods and services, which is the present taxation system, requires division of transaction values into value of goods and services for taxation, leading to greater complications, administration, including compliances costs.

- In the GST system, when all the taxes are integrated, it would make possible the taxation burden to be split equitably between manufacturing and services.

- GST will be levied only at the final destination of consumption based on VAT principle and not at various points (from manufacturing to retail outlets). This will help in removing economic distortions and bring about development of a common national market.

- GST will also help to build a transparent and corruption free tax administration.

- Presently, a tax is levied on when a finished product moves out from a factory, which is paid by the manufacturer, and it is again levied at the retail outlet when sold.

- GST is backed by the GSTN, which is a fully integrated tax platform to deal with all aspects of GST.

GST Disadvantages

- Some Economist say that GST in India would impact negatively on the real estate market. It would add up to 8 percent to the cost of new homes and reduce demand by about 12 percent.

- Some Experts says that CGST(Central GST), SGST(State GST) are nothing but new names for Central Excise/Service Tax, VAT and CST. Hence, there is no major reduction in the number of tax layers.

- Some retail products currently have only four percent tax on them. After GST, garments and clothes could become more expensive.

- The aviation industry would be affected. Service taxes on airfares currently range from six to nine percent. With GST, this rate will surpass fifteen percent and effectively double the tax rate.

- Adoption and migration to the new GST system would involve teething troubles and learning for the entire ecosystem.

For the Common Man – Items Expected to Get Cheaper

The following things/items are expected to become cheaper under GST for the common man:

- Prices of movie tickets may become cheaper in most states

- Dining in restaurants

- Two-wheelers

- Entry-level sedan (except small cars)

- SUVs and luxury or premium cars

- Televisions

- Washing machines

- Stoves

For the Common Man – Items Expected to Get Costlier

The following things/items are expected to become costlier under GST for the common man:

- Mobile bills

- Renewal premium for life insurance policies

- Banking and investment management services

- Basic luxuries for a common man like WIFI and DTH services, online booking of tickets may become costlier.

- Residential rent

- Health care

- School fees

- Courier services

- Commuting by metro or rail may become expensive.

- Aerated drinks

- Cigarettes and tobacco products.